Why Understanding Your Roof Replacement Insurance Claim Process Matters

A roof replacement insurance claim can feel like a daunting and overwhelming journey, but it doesn’t have to be. When a storm strikes or a tree falls, the last thing you want is a complicated battle with your insurance provider. Most standard homeowners insurance policies are designed to cover sudden, accidental damage from perils like wind, hail, fire, and falling objects. However, they explicitly exclude gradual wear and tear, damage from neglected maintenance, or issues arising from faulty installation. A successful claim hinges on a trifecta of preparation: a deep understanding of your policy, meticulous documentation of the damage, and a strategic partnership with experienced professionals who can advocate on your behalf.

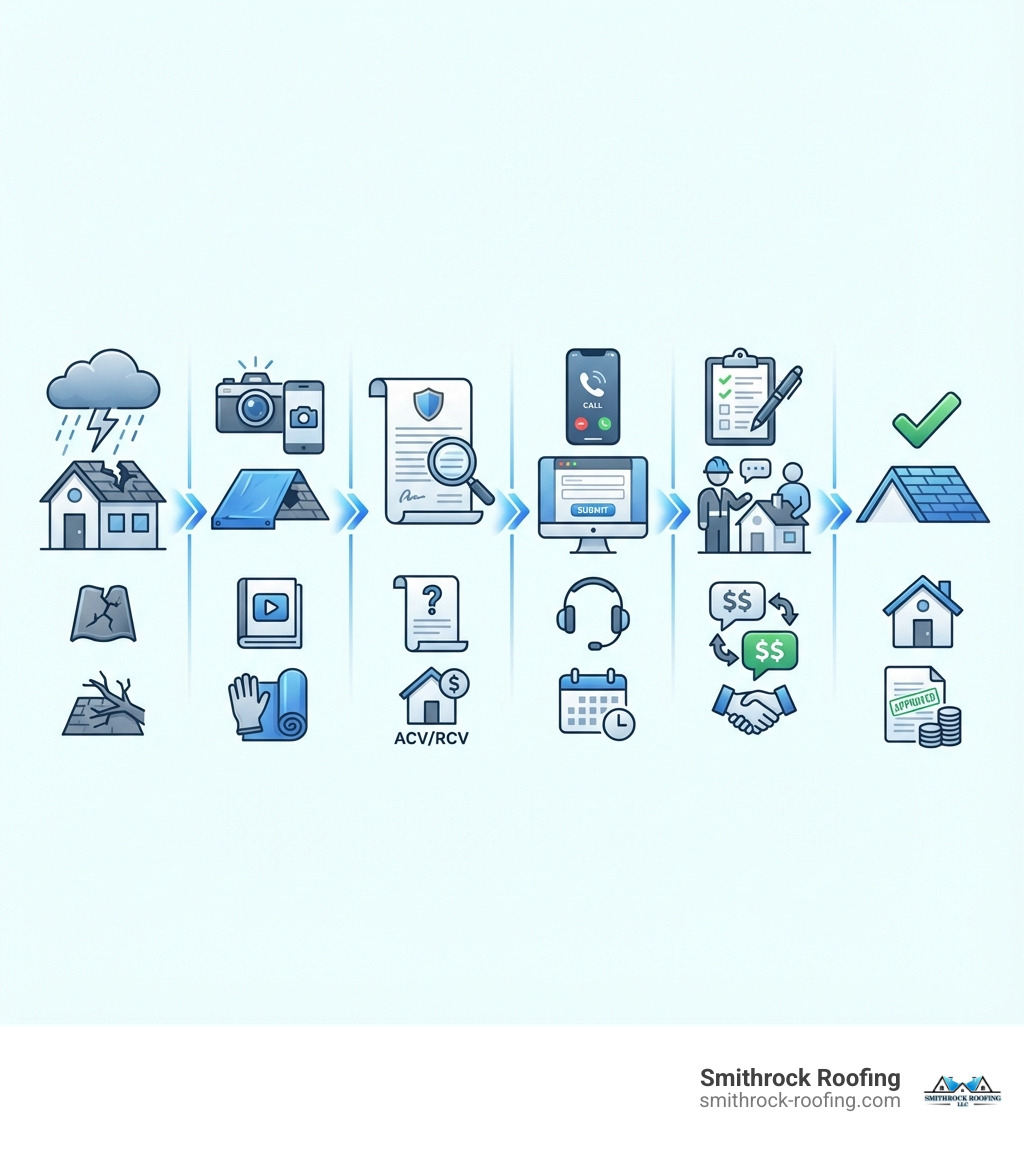

Here’s what you need to know to navigate this process successfully:

- Document Everything Immediately: Before you even think about calling your insurer, capture extensive photo and video evidence of the damage from multiple angles and distances. This is your primary proof.

- Review Your Insurance Policy: Locate your policy documents and understand the key terms. Do you have Actual Cash Value (ACV) or the more favorable Replacement Cost Value (RCV) coverage? What are your stated deductibles for different types of perils?

- Contact Your Insurance Company Promptly: Most policies require you to report a loss within a specific timeframe. Delaying can jeopardize your claim.

- Get a Professional Roof Inspection: Engage a licensed, local roofing contractor who is experienced with insurance claims. Their expert assessment is crucial for identifying all damage and building a strong case.

- Understand Your Deductible: Know the exact amount you are responsible for paying out-of-pocket. Be wary of any contractor who offers to “waive” or “absorb” this cost, as it is a form of insurance fraud.

- Be Prepared to Negotiate: The first settlement offer from an insurer is often just a starting point. Be ready to supplement your claim with additional evidence and costs to ensure you receive a fair payout.

It’s a well-documented fact that homeowners who seek professional representation, such as from a public adjuster or a claims-savvy roofing contractor, often receive higher claim payouts. This is logical; insurance companies employ a team of adjusters and experts whose primary role is to protect the company’s financial interests. Having an expert working exclusively for you levels the playing field.

Replacing a roof is one of the most significant investments you’ll make in your home, and your insurance policy exists to shield you from this substantial financial burden. Unfortunately, a large number of claims are denied or severely undervalued because homeowners inadvertently miss critical steps, lack proper documentation, or don’t understand the intricate language of their policy. The most common mistakes include filing too late, providing insufficient proof of loss, accepting the first lowball offer without question, and attempting to negotiate a complex claim without expert guidance.

This comprehensive guide is designed to demystify the entire roof replacement insurance claim process. We will walk you through each stage, from the initial damage assessment to the final roof installation, explaining what’s covered, how to document damage like a pro, when to call your insurer versus a contractor, and how to effectively handle disputes if they arise.

You’ve paid your premiums faithfully for years. Now it’s time to ensure you get the full coverage you are entitled to.

Terms related to roof replacement insurance claim:

Step 1: Assess the Damage and Understand Your Policy

The first and most critical step in any roof replacement insurance claim is to safely and thoroughly assess and document the damage. Your safety is paramount, so never climb onto a potentially damaged or wet roof. All initial inspections should be conducted from the ground or a securely placed ladder. Use a smartphone or camera to take an abundance of clear photos and videos. Capture wide shots of each slope of the roof to show the overall picture, then zoom in for detailed close-ups of specific damage points. Be sure to document the date, time, and the specific weather event (e.g., “hailstorm on May 15th at 4:00 PM”).

Look for these common signs of storm damage:

- Missing, Torn, or Creased Shingles: Wind doesn’t just blow shingles off; it can lift them, break the sealant bond, and create a crease. This damage is not always visible from the ground but leaves the roof vulnerable to leaks.

- Granule Loss: Look for an accumulation of black, sand-like granules in your gutters or on the ground near downspouts. These granules protect asphalt shingles from UV degradation. Significant loss, often caused by hail, is like a sunburn for your roof, drastically shortening its lifespan.

- Hail Impacts: Hail damage can be subtle. On asphalt shingles, it may look like dark bruises or dents where granules have been knocked off. On metal roofs, gutters, or vents, it will appear as distinct dings and dents.

- Collateral Damage: Don’t just look at the roof. Check for dents on gutters, downspouts, window screens, siding, and HVAC units. This “collateral damage” helps prove that your property was hit by a storm with sufficient force to damage the roof.

- Interior Evidence: Check your attic and ceilings for any signs of water intrusion, such as dark stains, peeling paint, or active drips. Document these immediately, as they add urgency and validity to your claim.

This documentation is your most powerful tool, creating a clear record that links the damage directly to a specific, covered event.

After documenting, you have a “duty to mitigate” further damage, as required by nearly all insurance policies. This means making reasonable temporary repairs, such as covering holes with a tarp or boarding up broken skylights. Keep every receipt for materials you purchase (tarps, plywood, nails), as these costs are typically reimbursable under your claim. For significant damage, especially from high winds, our team at Smithrock Roofing can provide emergency assistance with Wind Damage Repair Near Me to safely secure your property.

Next, locate and carefully review your homeowners insurance policy. Pay special attention to the “Declarations Page,” which summarizes your coverage, and the sections on “covered perils” and “exclusions.” The key distinction to understand is between “sudden, accidental damage,” which is covered, and gradual deterioration like “wear and tear” or neglect, which is not.

What Roof Damage Is Typically Covered?

Homeowners insurance is designed to protect you from unforeseen events. For roofing, this generally includes:

- Wind Damage: High winds, common in areas like Winston-Salem and Greensboro, can lift, tear, or blow off shingles, compromising the entire roofing system.

- Hail Damage: Hailstorms can cause bruising, cracking, and granule loss that may not cause immediate leaks but will severely degrade the roof’s ability to protect your home over time. Our team is highly experienced in identifying these often-subtle signs during a Hail Damage Home Repair inspection.

- Falling Objects: Damage from trees, branches, or other debris falling on your roof during a storm is a classic covered peril.

- Fire and Lightning: Damage from a house fire, wildfire, or a lightning strike is covered.

- Weight of Ice and Snow: In colder climates, the immense weight of accumulated ice and snow can cause structural damage, which is often a covered event.

Common Covered Perils Checklist:

- Windstorms & Tornadoes

- Hailstorms

- Falling trees/branches

- Fire & Smoke

- Lightning

- Vandalism

- Weight of snow/ice

Policies can have specific limitations, so always verify the details with your specific carrier.

Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

This is the single most important clause in your policy regarding a roof replacement insurance claim. It dictates how much money you will receive.

- Actual Cash Value (ACV): This policy pays for the depreciated value of your roof. The insurance company calculates the cost to replace your roof today and then subtracts a percentage for its age and condition. For example, if a new roof costs $20,000 and your 15-year-old roof is determined to have a 30-year lifespan, the insurer might depreciate it by 50% ($10,000). Your payout would be $10,000, minus your deductible. This leaves you with a significant out-of-pocket expense to cover the depreciation.

- Replacement Cost Value (RCV): This is superior coverage. It pays the full cost to replace your roof with new materials of similar kind and quality, without a deduction for depreciation. The payout is typically a two-part process. First, the insurer pays the ACV amount. Then, once you have completed the roof replacement and submitted the final invoice from your contractor, the insurer releases the withheld depreciation amount, known as “recoverable depreciation.” Your only out-of-pocket cost is your deductible.

As the Texas Department of Insurance explains, understanding this difference is crucial. It’s the difference between getting a check that covers most of the project versus one that covers less than half. Look for endorsements on your policy as well, such as “matching coverage” (which may require the insurer to replace undamaged sections to ensure a uniform appearance) or “code upgrade coverage” (which pays for extra costs required to bring your new roof up to current building codes).

Here’s a quick comparison:

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|

| Coverage | Cost to replace minus depreciation | Full cost to replace with new, like-kind material |

| Example Payout (on a $20k roof with 50% depreciation) | ~$10,000 (before deductible) | ~$20,000 (before deductible) |

| Initial Payout | One-time payment of the depreciated value | Initial payment of the ACV amount |

| Final Payout | No further funds are paid | Second payment for “recoverable depreciation” after work is complete |

| Homeowner Cost | Deductible + All Depreciation | Deductible Only |

Knowing your coverage type is the foundation of a successful roof replacement insurance claim.

Step 2: The Step-by-Step Guide to Filing Your Roof Replacement Insurance Claim

Once you have documented the damage and have a basic understanding of your policy, it’s time to formally initiate your roof replacement insurance claim. This phase involves precise communication with your insurance provider, understanding the roles of the various adjusters, and making the strategic decision to bring in a professional roofing contractor as your advocate.

Promptly notifying your insurer is a contractual obligation. Most policies contain a clause requiring you to report damage “as soon as reasonably possible.” Waiting weeks or months can create suspicion and give the insurer grounds to deny the claim. You can typically file a claim through a dedicated 24/7 claims hotline, via your insurer’s website or mobile app, or by contacting your local insurance agent.

When you make the call, be prepared and professional. Have the following information ready:

- Your policy number

- The address of the damaged property

- The date the damage occurred (your “date of loss”)

- A brief, factual description of the event (e.g., “We experienced a severe hailstorm, and I’ve observed damage to my shingles and gutters.”)

Important Tip: Stick to the facts. Do not speculate on the extent of the damage or admit any potential fault. Simply state that you have sustained damage from a covered peril and wish to open a claim. The representative will provide you with a claim number—guard this number, as it will be your reference for all future correspondence. The insurer will then assign an adjuster to your case.

Should You Hire a Roofer Before or After Filing?

This is a pivotal question with a clear answer: it is almost always in your best interest to have a reputable, local roofing contractor, like Smithrock Roofing, perform a thorough inspection before the insurance adjuster arrives. Here’s why this is a game-changer:

- Comprehensive Damage Assessment: A trained roofer can safely access your roof and identify all forms of damage, including subtle issues like lifted shingles, broken seals, and minor hail impacts that an untrained eye—or an adjuster in a hurry—might miss. This ensures the full scope of the damage is known from the outset.

- Professional Documentation: We don’t just take pictures; we create a detailed report with annotated photos and diagrams that speak the language of insurance. This professional assessment provides a powerful counterpoint to the adjuster’s report and strengthens your claim’s validity.

- An Advocate on Your Side: The insurance adjuster works for the insurance company. Their goal is to close the claim efficiently and for the lowest possible amount that the policy allows. Your roofing contractor works for you. Having them on-site during the adjuster’s inspection ensures that no damage is overlooked and that the assessment is fair and complete.

- Avoiding Storm-Chasing Scams: After a major storm hits communities like Winston-Salem, Greensboro, or High Point, the area is often flooded with “storm chasers.” These are out-of-state contractors who swoop in, make grand promises, perform shoddy work, and disappear, leaving homeowners with a voided warranty. Red flags include high-pressure tactics, demands for large upfront payments, and offers to “eat” your deductible (which is insurance fraud). By partnering with a trusted local company like Smithrock Roofing, you are choosing a business with a permanent presence and a reputation to uphold in communities like King, Clemmons, and Lewisville. We are your neighbors and will be here to stand by our work. Find trusted Roofing Contractors in Winston Salem and the surrounding areas.

Once you file, the insurer will schedule their adjuster’s visit. It is crucial to schedule your chosen contractor to be present for this meeting. This creates a collaborative environment where your roofer can point out specific damage points, discuss necessary code requirements, and present their findings directly to the adjuster. This simple step can prevent countless back-and-forth negotiations and dramatically increase the likelihood of a fair initial assessment. Our team can provide a detailed Roof Estimate based on this comprehensive inspection, which will serve as a baseline for negotiating the final settlement.

Step 3: Navigating the Settlement and Handling Disputes

Following the adjuster’s inspection, you will receive a formal document known as a “Scope of Loss” or “Summary of Estimate.” This outlines the damage the insurer has acknowledged and the corresponding settlement offer. It is critical that you review this document with a fine-toothed comb and do not feel pressured to accept the first offer. Initial estimates from insurance companies are notoriously low. They are often generated using standardized software like Xactimate and may omit dozens of necessary line items.

This is where the process of “supplementing the claim” becomes essential. A supplement is a formal request to the insurance company for additional funds to cover legitimate costs that were missed in the original estimate. An experienced, claims-savvy contractor is invaluable here. Our team will meticulously review the adjuster’s scope of work and identify missing items, which commonly include:

- Essential Roofing Components: Starter strips, ridge caps, hip shingles, and proper flashing.

- Code-Required Items: Ice and water shield, drip edge, and proper ventilation to meet current local building codes.

- Labor and Access Costs: Additional charges for steep-slope roofs, multi-story access, and complex roof geometries.

- Overhead and Profit: A standard industry percentage (typically 10% overhead and 10% profit) that a legitimate contractor needs to operate their business.

- Ancillary Costs: Permit fees, debris removal and disposal fees, and sales tax on materials.

We will compile these missing items into a professional supplement request, complete with photos, code references, and pricing, and submit it to your insurer. This negotiation ensures that the final approved amount is sufficient to restore your roof correctly, without cutting corners.

What is a Deductible and How Does It Work?

A deductible is the fixed amount of money you are contractually obligated to pay out-of-pocket before your insurance coverage kicks in. This amount is subtracted from the total claim settlement.

- Fixed Dollar Amount: Most policies have a standard deductible, such as $1,000, $2,500, or more. If your approved claim is for $20,000 and your deductible is $2,000, your insurer will pay out a total of $18,000.

- Percentage-Based Deductible: Increasingly common in storm-prone areas, this deductible is a percentage (e.g., 1%, 2%, or even 5%) of your home’s total insured value (Dwelling Coverage). If your home is insured for $400,000 with a 2% deductible, you would be responsible for the first $8,000 of any storm-related claim. These are often called “hurricane” or “named storm” deductibles.

Crucially, you are legally required to pay your deductible. Any contractor who offers to “waive,” “cover,” or “absorb” your deductible is asking you to commit insurance fraud. They typically accomplish this by submitting an inflated invoice to the insurance company to cover the difference, which is illegal and can have severe consequences for both you and the contractor.

Common Reasons for a Denied Roof Replacement Insurance Claim

Even with diligent preparation, a roof replacement insurance claim can be denied. Understanding the common reasons can help you build a stronger case or form the basis of an appeal.

- Old Roof Age & Wear and Tear: If your roof is over 20 years old and shows signs of advanced wear, the insurer may argue the damage is not from a single storm event but from gradual deterioration, which is not covered.

- Lack of Maintenance: Evidence of neglect, such as unaddressed leaks, excessive moss growth, or clogged gutters causing water backup, can lead to a denial.

- Pre-existing Damage: The adjuster may claim the damage existed before the date of loss you are claiming.

- Improper Installation: If the roof was installed incorrectly, leading to its failure during a storm, the insurer may deny the claim and state the liability rests with the original installer. This is why using reputable, Experienced Roofing Contractors with a solid Warranty is so important.

- Not a Covered Peril: The damage must stem from an event listed in your policy. Damage from floods, earthquakes, or pests, for example, typically requires separate coverage.

- Filing Too Late: Your policy has strict time limits for reporting a claim. Waiting too long makes it difficult to prove the damage was caused by a specific event.

What to Do If Your Claim is Denied or Undervalued

A low offer or denial is not the end of the road. You have several recourse options:

- Request the Denial in Writing: Demand a formal letter from the insurer that clearly explains the specific reasons for the denial, citing the exact policy language they are using to justify their decision.

- Get a Roofer’s Second Opinion: If the denial is based on the adjuster’s damage assessment, have our team at Smithrock Roofing perform a new, highly detailed inspection to provide professional evidence that contradicts the insurer’s findings.

- File an Official Appeal: Use your insurance company’s internal appeals process to formally dispute the decision. Present your case clearly with all your supporting evidence, including your contractor’s report and any new documentation.

- Invoke the Appraisal Clause: Most policies contain an “Appraisal Clause” for resolving disputes over the cost of repairs. In this process, you and the insurer each hire an independent appraiser. The two appraisers then select a neutral “umpire.” An agreement by any two of these three parties is binding. This is a powerful tool for breaking a stalemate on the settlement amount.

- Hire a Public Adjuster: For very large or complex claims, a licensed public adjuster works exclusively for you, managing the entire claim and negotiation process. They work on a contingency fee, typically a percentage of the final settlement, and studies show they often secure significantly higher payouts.

- Contact Your State’s Department of Insurance: As a final step, you can file a formal complaint with your state’s regulatory body (the NC Department of Insurance for North Carolina). They can investigate whether your insurer acted in bad faith and can help mediate the dispute.

Step 4: Choosing a Contractor and Completing the Replacement

Once your roof replacement insurance claim is approved and you have a fair settlement amount agreed upon, you enter the final and most tangible phase: choosing the right contractor to build your new roof. This decision is just as critical as the claim negotiation itself, as it directly impacts the quality, durability, and longevity of your most important asset.

When vetting and selecting a roofing contractor, prioritize these key qualifications:

- Local and Established: Choose a company with a permanent physical office and a long-standing reputation in your community (Winston-Salem, Greensboro, etc.). A local contractor is accountable, familiar with local building codes, and will be there to service your warranty for years to come. Avoid out-of-state “storm chasers.”

- Properly Licensed and Insured: This is non-negotiable. Verify their state license and ask for proof of insurance. They must carry both General Liability insurance (to protect your property from damage) and Worker’s Compensation insurance (to protect you from liability if one of their employees is injured on your property). Hiring an uninsured contractor is a massive financial risk.

- Verifiable Experience and Reputation: Look for a company with a proven track record. Check online reviews on Google, the Better Business Bureau (BBB), and other platforms. Ask for a portfolio of past work and a list of local references you can contact.

- Deep Insurance Claim Experience: As this guide illustrates, the insurance process is complex. You need a contractor who not only knows how to build a roof but also understands how to navigate claims, write supplements, and communicate effectively with adjusters.

- Commitment to Quality Materials and Workmanship: A great contractor will explain the different material options available and won’t cut corners on installation. They should provide a detailed written warranty covering both materials and their labor.

Before any work begins, demand a detailed written contract. This legal document should explicitly state the full scope of work, the specific materials to be used (brand, color, type), a clear payment schedule tied to project milestones, and the complete warranty details. Once the work is finished, perform a final walkthrough with the contractor to ensure every detail meets the agreed-upon terms before making the final payment.

Why Hire a Contractor Experienced with the Roof Replacement Insurance Claim Process?

A contractor who specializes in insurance claims brings a unique and powerful skill set to your roof replacement insurance claim:

- Expert Damage Identification: They are trained to spot all types of storm damage, ensuring the full scope of loss is presented to the insurer.

- Proficiency in Insurance Software: Most insurers use estimating software like Xactimate. An experienced contractor knows how to use this same software to create a detailed, line-by-line estimate that justifies the true cost of replacement, making it easier for the adjuster to approve supplements.

- Strategic Adjuster Meetings: They act as your professional representative during the adjuster inspection, pointing out damage and discussing the necessary scope of repair from an expert’s perspective.

- Efficient Supplement Management: They know precisely what is and isn’t included in initial estimates and can quickly prepare and submit the necessary supplements to cover all legitimate costs, preventing you from having to pay for them out-of-pocket.

- Code Compliance Guarantee: They are experts on local building codes and will ensure your claim includes the costs to bring your new roof up to current standards, a crucial and often overlooked expense.

- Stress Reduction: They manage the technical details, paperwork, and communication with the insurer, allowing you to focus on your life while they handle the complexities of the claim.

Our team at Smithrock Roofing includes Experienced Roofing Contractors who are deeply versed in the insurance claim process. Many undergo continuous education, such as the GAF Storm Restoration Training, to master the latest best practices in storm damage assessment and claims negotiation.

Can a New Roof Lower Your Insurance Premiums?

Yes, installing a new roof, especially one with enhanced features, can often lead to a reduction in your homeowners insurance premiums. Insurers base their rates on risk; a new, more resilient roof presents a lower risk of future claims.

- Impact-Resistant Materials: Installing shingles with a high impact rating (such as UL 2218 Class 4) can qualify you for significant discounts in hail-prone regions. These shingles are specifically designed to withstand damage from hail, reducing the likelihood of a future claim.

- FORTIFIED Roof™ Program: This advanced program from the Insurance Institute for Business & Home Safety (IBHS) goes beyond standard building codes to create a stronger, more resilient roofing system. A certified FORTIFIED Roof™ can make you eligible for substantial premium reductions and other incentives in many states.

- Overall Risk Reduction: Even a standard new roof is seen more favorably by insurers than an old, aging one. Simply having a new roof with a fresh lifespan can sometimes prevent premium hikes or make you eligible for better coverage terms.

When planning your replacement, discuss these options with both your insurance agent and our team at Smithrock Roofing. We can help you select materials that not only provide superior protection for your home but also deliver long-term financial savings. Learn more on our More info about our roofing services page.

Frequently Asked Questions about Roof Insurance Claims

We understand that the roof replacement insurance claim process is filled with questions and uncertainties. Here are detailed answers to some of the most common questions we hear from homeowners in Winston-Salem and across North Carolina.

How does the age and condition of a roof affect my claim?

Your roof’s age and pre-storm condition are two of the most significant factors in any insurance claim. An insurer will always consider them when assessing liability.

- Depreciation and ACV: As a roof ages, its value depreciates. If you have an Actual Cash Value (ACV) policy, your payout will be directly reduced by this depreciation. For a roof over 15-20 years old, this can mean the insurance payout covers less than half the replacement cost.

- Increased Risk of Denial: For an older roof (typically 20+ years), an insurer is more likely to deny a claim by arguing that the failure was due to age and accumulated wear and tear rather than a specific storm event. They may claim the shingles were already brittle and at the end of their service life.

- Policy Changes: As a roof gets older, many insurance companies will automatically switch your coverage from Replacement Cost Value (RCV) to ACV at renewal time, or they may add endorsements that limit coverage for wind and hail damage.

- Insurability: An old or poorly maintained roof can make it difficult to get or renew homeowners insurance altogether. Many carriers will not write a new policy for a home with a roof over 20 years old.

This underscores the value of proactive maintenance and regular inspections. Our Benefits of Regular Roof Inspections can help you maintain your roof’s condition, extending its life and strengthening your position in a future claim.

Does homeowners insurance cover roof leaks?

This is a nuanced question. Coverage for a roof leak depends entirely on the cause of the leak.

- Covered: If the leak is a direct result of a sudden, accidental, and covered peril (like a windstorm blowing off shingles or a tree branch puncturing the roof), then the cost to repair the roof and any resulting interior water damage is typically covered.

- Not Covered: If the leak is due to gradual deterioration, such as old, worn-out flashing, cracked pipe boots, or a general lack of maintenance, the cost to fix the leak itself is generally not covered. This is considered a maintenance issue, which is the homeowner’s responsibility. However, the ensuing water damage to the interior of your home might still be covered, provided you took reasonable steps to stop the leak once you discovered it.

It is always critical to address any Roof Leak Repair needs immediately to prevent further damage.

What is the statute of limitations for filing a roof damage claim?

The statute of limitations is the legal deadline for taking action, but in insurance, there are often two timelines to consider:

- Policy-Specific Timeline: Your insurance contract will state that you must notify the insurer of a loss promptly or “as soon as reasonably possible.” This is the most important deadline. Waiting several months without a good reason can be grounds for denial.

- State Statute of Limitations: This is the legal time frame within which you can file a lawsuit against your insurer for a breach of contract. In North Carolina, for example, this is typically three years. However, you should never wait this long to file your initial claim.

Best practice is to file your roof replacement insurance claim as soon as you discover the damage. The longer you wait, the more difficult it becomes to definitively link the damage to a specific “date of loss,” which is essential for a successful claim.

Will my insurance premiums go up if I file a roof claim?

This is a common fear. While it’s possible for any claim to affect your future premiums, claims related to widespread natural disasters (often called “Act of God” events) are treated differently than other claims (like liability or theft). An insurer cannot single you out for a rate increase because you filed a claim after a hailstorm that affected your entire neighborhood. They may, however, raise rates for the entire area (zip code) due to the increased risk. The financial risk of not filing a claim and leaving a damaged roof unrepaired—which can lead to major structural issues and interior damage—is far greater than the risk of a potential premium increase.

What if the insurance check is made out to both me and my mortgage company?

This is standard procedure if you have a mortgage. Your lender has a financial interest in your home and wants to ensure the property is repaired. You will need to contact your mortgage company’s loss draft department to understand their process. Typically, you will endorse the check and send it to them. They will then release the funds in installments: an initial amount to start the work, and the final amount after you provide proof (like a certificate of completion from your contractor) that the replacement is finished.

What if my shingles are discontinued and can’t be matched?

This is a very important situation that often leads to a full roof replacement. If a storm damages a section of your roof and the specific shingles are no longer manufactured, a simple repair is impossible. Many state regulations and policy clauses (often related to maintaining a uniform appearance) require the insurer to replace the entire slope or even the entire roof to ensure a reasonable match. An experienced contractor will know how to identify a discontinued shingle and use that fact to properly negotiate for a full replacement when it is warranted.

Your Partner in a Stress-Free Roof Replacement

Navigating a roof replacement insurance claim is undoubtedly a complex and often stressful journey. However, as we’ve detailed, you can take control of the process and achieve a successful outcome. We’ve walked through the essential steps: the critical importance of immediate and thorough damage documentation, the necessity of understanding your policy’s key provisions like ACV vs. RCV, the strategic value of prompt communication with your insurer, and the absolute necessity of partnering with an experienced, local roofing contractor who can serve as your advocate.

The key takeaway is that a successful claim is not a passive process; it is a proactive one. It requires diligence, knowledge, and the right professional support to level the playing field.

At Smithrock Roofing, we are more than just expert roofers; we are your dedicated partners and advocates throughout the entire insurance process. We proudly serve homeowners across Winston-Salem, King, Clemmons, Lewisville, Pilot Mountain, East Bend, Mt. Airy, Kernersville, and the surrounding North Carolina communities. Our deep understanding of local weather patterns, regional building codes, and the intricate workings of the insurance industry allows us to provide unparalleled guidance and superior workmanship. Our mission is to manage the complexities of your claim, ensuring you receive a fair, complete, and timely settlement to restore your roof to its optimal condition.

Don’t let the burden of a damaged roof and a confusing insurance claim overwhelm you. Let our team provide you with a fair and complete New Roof Cost assessment based on the full scope of work required. We will guide you through every step of your roof replacement insurance claim, from the first inspection to the final nail.

For expert assistance with your storm damage and to ensure you get the full compensation you deserve, Contact Us today for a free, no-obligation inspection. We are here to protect your home, your investment, and your peace of mind.